salt tax deduction repeal

54 rows Some lawmakers have expressed interest in repealing the SALT cap which was originally imposed as. SALT Repeal Just Below 1 Million is Still Costly and Regressive.

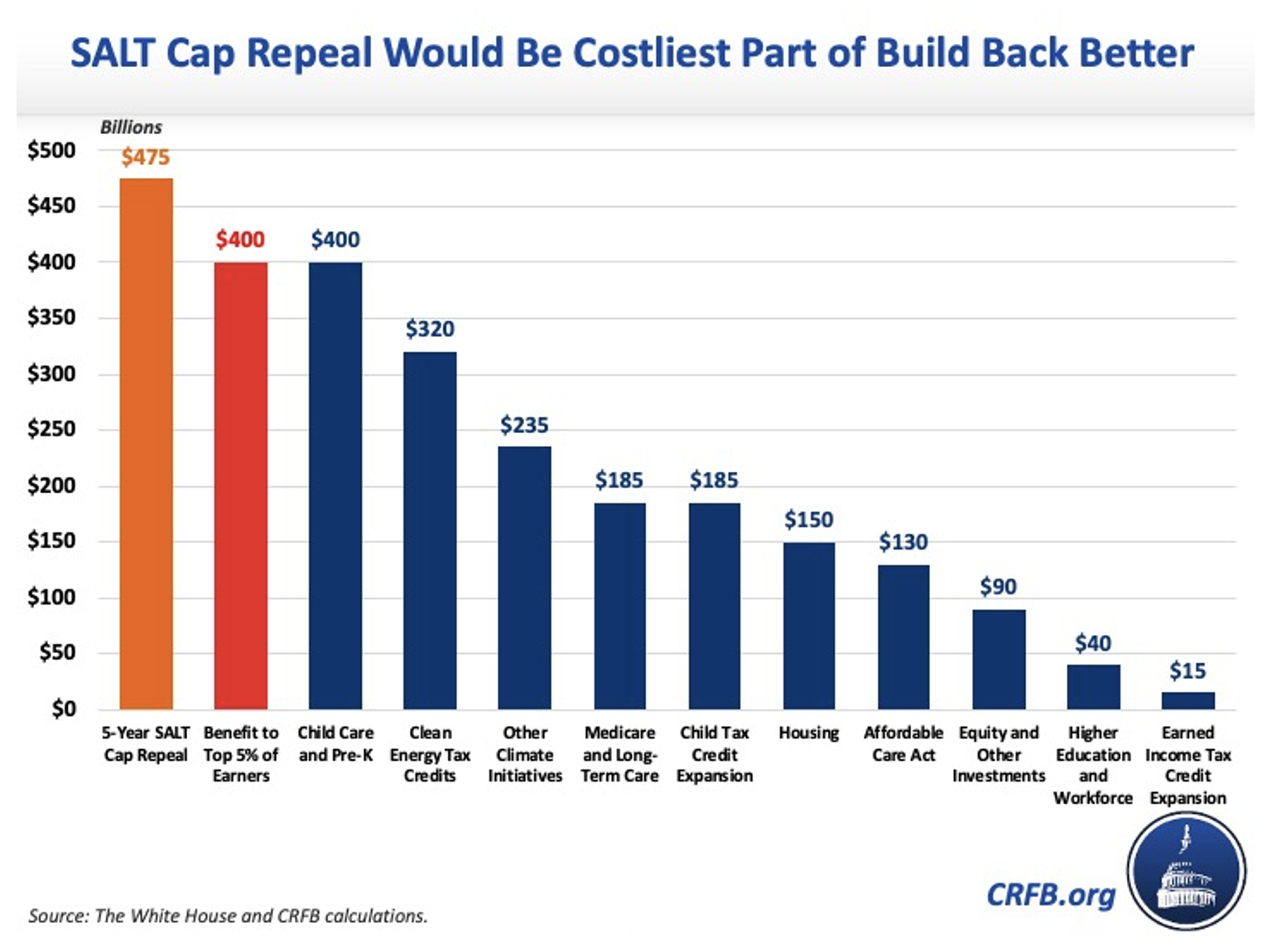

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

However the bill stalled in December.

. Americans who rely on the state and local tax SALT deduction at tax time may be in luck. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the 10000 limit in 2031. The United States Supreme Court rejected New Jersey and other states requests to restore the full income tax deduction for state and local taxes.

House Democrats agreed to a compromise that would raise it to 80000 per year but it was part of the broader Build Back Better Act which. SALT Cap Repeal TCJA The after-tax income of the top one percent rose by almost 35 percent as a result of the TCJA. Legislative efforts to repeal the SALT cap are stalled.

Nov 19 2021 Taxes According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. A Democratic proposal aims.

11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for state. SB 113 which Governor Gavin Newsom signed into law on February 9 2022 expands the states workaround of the federal deduction limit for state and local taxes SALT and repeals the net operating loss NOL suspension and business credit limits. The SALT tax deduction is currently capped at 10000.

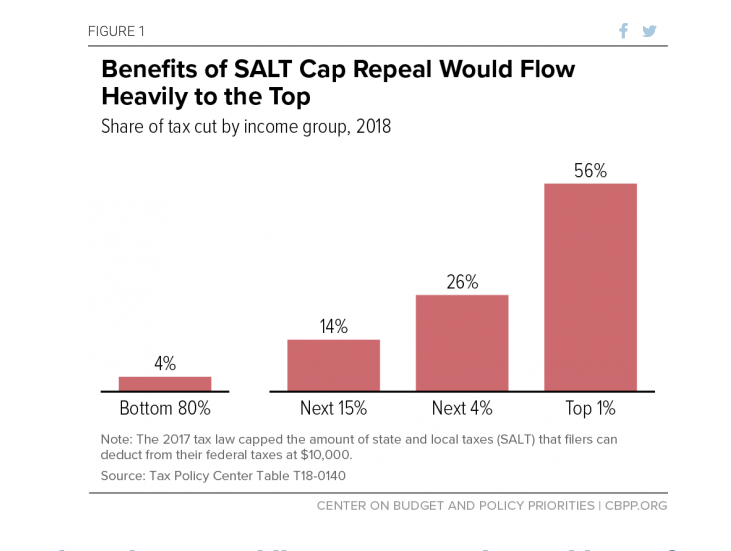

While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break for the wealthy. A group of moderate lawmakers are pushing to repeal the so-called SALT deduction cap in the reconciliation package saying no SALT no deal but other Democrats are trying to slam the brakes on. That should spell the end for the SALT deduction a benefit for high earners in high-tax states.

For the rest of the top quintile it meant a. Prior to the Republican tax reform of 2017. The so-called SALT deduction cap which is poised to sunset in 2026 limits the amount of state and local taxes that Americans can deduct from their federal taxes to 10000.

Pelosi defends SALT deduction in Dems spending bill insists it wont benefit the rich Pelosi contradicts nonpartisan analyses showing SALT repeal is boon to the rich By Megan Henney FOXBusiness. The Tax Cuts and Jobs Act of 2017 TCJA imposed a 10000 cap on the itemized deduction for state and local taxes SALT from 2018 through 2025. TPC estimated repeal would reduce federal tax revenues by 620 billion between 2018 and 2028 In an interview Gleckman said the courts move was not a surprise This always was a long shot.

A new bill seeks to repeal the 10000 cap on state and local tax deductions. Marie Sapirie examines the proposal to repeal or at least raise the state and local tax deduction and the efforts to expand the child tax credit in terms of contrast and she questions whether. As alternatives to a full repeal of the cap lawmakers and experts have proposed a number of changes to the SALT deduction.

Recently passed budget legislation in California will bring significant tax reductions to business and individual taxpayers. For example policymakers have proposed doubling the cap for married couples or making it more generous. Many New Jersey residents pay more than 10000 in property taxes.

We should be able to deduct our full property tax. Many Democrats from high-tax states have. Such a plan would be still be very costly and regressive.

This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year. Republicans 2017 tax cut law created a 10000 cap on the SALT deduction in an effort to raise revenue to help pay for tax cuts elsewhere in the measure.

In states that have PTET legislation a pass-through entity elects to pay state-level taxes at the entity level rather than passing on the full tax liability to individual owners with state tax credit to individual owners for state taxes paid by the entity. The proposal has faced. The entity which is not subject to the SALT cap may claim a federal Section 164 business expense deduction and shareholders.

Democrats in New York New Jersey and California have led a fight for years to repeal the so-called SALT cap which since 2017 has limited the federal income-tax deduction for state and local. As Congress struggles to pass the Build Back Better bill some congressional Democrats are exploring new proposals to raise the 10000 cap on the state and local tax SALT deduction.

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Why Repealing The State And Local Tax Deduction Is So Hard

This Bill Could Give You A 60 000 Tax Deduction

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

The Tax Break Down The State And Local Tax Deduction Committee For A Responsible Federal Budget

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

State And Local Tax Salt Deduction Salt Deduction Taxedu

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix